Matching

|

|

|

Identifying Key Terms

Match each term with the correct

statement below. a. | appropriations bill | f. | national debt | b. | crowding-out

effect | g. | productive

capacity | c. | federal budget | h. | Treasury bill | d. | fiscal policy | i. | Treasury bond | e. | multiplier

effect | j. | Treasury

note |

|

|

|

1.

|

the maximum output that an economy can sustain over a period of time

|

|

|

2.

|

a written document indicating the amount of money the government expects to

receive for a certain year and authorizing the amount of money the government can spend that

year

|

|

|

3.

|

the idea that every one dollar change in fiscal policy creates a greater than

one dollar change in the national income

|

|

|

4.

|

federal government’s use of taxing and spending to keep the economy

stable

|

|

|

5.

|

a type of short-term bond that must be repaid within a year or less

|

|

|

6.

|

a type of bond that the issuer may take as long as 30 years to repay

|

|

|

7.

|

when the level of federal borrowing makes it more difficult for private

businesses to borrow

|

|

|

8.

|

total amount of money the federal government owes

|

Multiple Choice

Identify the

choice that best completes the statement or answers the question.

|

|

|

9.

|

Every hour, the federal government spends about

a. | $250 thousand. | c. | $250 million. | b. | $25 million. | d. | $25 billion. |

|

|

|

10.

|

The federal budget is put together

a. | every other year. | b. | by Congress and the White

House. | c. | to report to Congress on the preceding year’s expenditures. | d. | in order to

reimburse state governments for costs of federally funded programs. |

|

|

|

11.

|

An example of expansionary fiscal policy would be

a. | cutting taxes. | c. | cutting production of consumer goods. | b. | cutting government

spending. | d. | cutting prices of

consumer goods. |

|

|

|

12.

|

All of the following are reasons why it is difficult to put balanced fiscal

policy into practice EXCEPT

a. | the need for discretionary spending. | b. | political pressures for

reelection. | c. | difficulty of predicting future economic performance. | d. | difficulty of

coordinating the needs of many different agencies. |

|

|

|

13.

|

All of the following people are well-known classical economists EXCEPT

a. | Adam Smith. | c. | Arthur Laffer. | b. | David Ricardo. | d. | Thomas Malthus. |

|

|

|

14.

|

In contrast with classical economics, Keynesian economics

a. | reduces the role of government. | b. | takes a broader view of the

economy. | c. | relies more heavily on the laws of supply and demand. | d. | more strongly

emphasizes the importance of individual businesses to the overall health of the

economy. |

|

|

|

15.

|

When revenues exceed expenditures,

a. | there is a budget surplus. | b. | there is a budget deficit. | c. | the government must

create more money. | d. | the government is forced to issue more bonds to

raise money. |

|

|

|

16.

|

When you buy a United States Savings Bond, you

a. | loan money to the government. | b. | borrow money from a savings and loan

association. | c. | donate money for special government projects. | d. | pay for your

child’s college education. |

|

|

|

17.

|

Keynesian economics failed to deal successfully with

a. | World War II. | b. | the Great Depression. | c. | high inflation

during the 1970s. | d. | low unemployment rate during the

1960s. |

|

|

|

18.

|

The national debt rose during Ronald Reagan’s term as President for all of

the following reasons EXCEPT

a. | tax cuts. | b. | the costs of running a war. | c. | increased funding

for defense spending. | d. | an unexpected economic

downturn. |

|

Short Answer

|

|

|

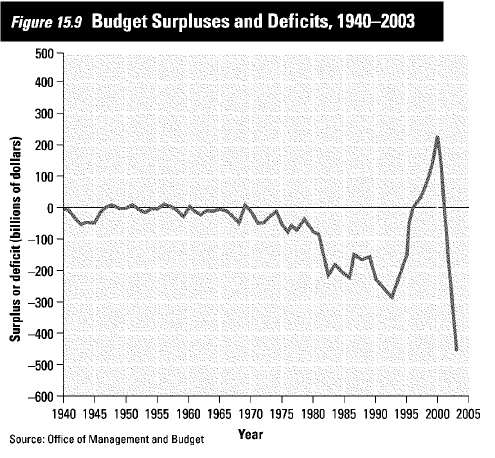

Interpreting a Graph

|

|

|

19.

|

About what year was the budget deficit the highest?

|

|

|

20.

|

What was true about revenues and expenditures in 1950?

|

|

|

21.

|

What was the general trend of government revenues and expenditures during the

early 1950s?

|

|

|

22.

|

About what year was the budget surplus about $40 billion?

|

Essay

|

|

|

Critical Thinking

|

|

|

23.

|

Synthesizing Information What office prepares the federal budget?

Describe the process it follows.

|

|

|

24.

|

Making Comparisons How does supply-side economics differ from Keynesian

economics?

|